Here are some recent articles of interest that I found this week related to law practice management, law technology, and legal marketing. Enjoy!

Here are some recent articles of interest that I found this week related to law practice management, law technology, and legal marketing. Enjoy!

Legal Tech Tips: Video depositions, Lights, camera, deposition

A few tips to help witnesses handle video-recorded Q&A’s

I once believed that when being deposed, the best strategy was to answer the question as tersely as possible. After all, the purpose of the deposition is to know what the other side knows.

It is an attempt to level the information playing field. You get to see inside their file cabinet, and they get to see inside yours. There was no need to wear a suit, sit up straight or be polite. Each side just hunkered down for a few hours or a few days; one side digging and the other side dribbling until it came time to switch roles.

Read more here…

Law Practice Management Tip: So you’re not up at 5am to work? What’s wrong with you? Nothing.

I cringe every time I read a story about a person who starts their day at 4am, after surviving on only 5 hours sleep, to get up and start yet another highly productive day. They’ve written their first client brief before their ‘all greens’ smoothie and done a mini-triathlon by 7am.

After a quick shower, they ride 10kms to their work and ‘start’ their day by reading all their newspapers in an allocated 30 minute slot. Then it’s the team meet up before a full one day of meetings, workshops, team time outs and a session at the gym topped off with a protein shake. It goes on. You get the drift.

By the time I also learn they have their two, five and ten year plan mapped out, I am weeping.

Read more here…

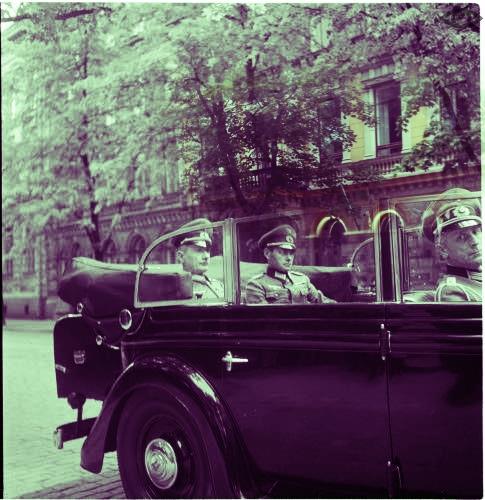

Legal Technology Tips: Persuasive Litigator: Don’t Assume the Camera Is Neutral

Cameras don’t simply record what is in front of the lens. Every movie director knows that the camera highlights, frames, hides, emphasizes and distorts. The Francis Ford Coppola’s among them know that they’re not simply filming, they’re ‘painting with light’ using the film as a canvas. The legal uses of cameras – interrogations, depositions, site visits — are a bit more prosaic than that, but they’re not immune to the camera’s lack of neutrality. In a legal setting, the consequences of mistaking the recorded image for unfiltered reality can be greater. And the practical need to check out the camera’s influence is great as well.

Read more here…

Legal Marketing: Is it unethical for lawyers to use ghostwritten blog posts?

Kevin O’Keefe says that ghostwritten blog posts are unethical for lawyers. Unlike legal briefs or other work a lawyer may have penned by others, blogs are considered a form of advertising. If you say you wrote the piece but you didn’t, you are guilty of misrepresentation.

O’Keefe says that clients rely on blog posts to choose attorneys. “The ghost-written post may be better written, funnier, or just plain different than the attorney’s own work product. Even worse, the post may have a completely different perspective or contain better ideas than what the attorney is capable of.”

Basically, clients might hire you because you made them believe you are a better lawyer than you really are.

Read more here…

Law Practice Management Tip: The First Step to Heading Off Unpaid Receivables

I’m addicted to using my law firm to earn points and miles on our credit card expenditures. On top of that, I love getting the signup bonuses.

To further my addiction, I signed my wife up for cards after I’d used up all the offers in my name. She was promptly approved for cards with Chase, American Express, and others.

The fact that she was approved only gets interesting if you know that she hasn’t earned any significant income in more than two decades. Her applications were instantly approved online as she hit the “apply” button.

So with no income, she was approved for credit. That’s interesting, but what does it have to do with your practice? Everything.

Read more here…

Thank you for reading (and sharing). Stay tuned for next week’s weekly review for Law Practice Tips!

Here are some recent articles of interest that I found this week for the insurance industry, Florida insurance law, Florida insurance claims, and Florida insurance trends. Enjoy!

Here are some recent articles of interest that I found this week for the insurance industry, Florida insurance law, Florida insurance claims, and Florida insurance trends. Enjoy!